Introduction to Car Insurance Coverage

For every driver, understanding the essentials of car insurance is not just about meeting legal requirements—it’s about ensuring financial protection on and off the road. Knowing what each type of coverage offers is crucial in case of accidents, theft, and natural disasters as real possibilities. The three core types—liability, collision, and comprehensive—form the backbone of most car insurance policies. Each provides distinct protections tailored to different needs and driving scenarios. Early on, it’s wise to familiarize yourself with AARP vehicle insurance options and compare what’s available to find the plan that best matches your lifestyle.

The peace of mind from robust coverage can be invaluable, especially after an unexpected event. If you’re involved in a crash, face costly repairs, or suddenly lose your car to theft, the right insurance can shield you from devastating financial loss. At the same time, insurance requirements and options aren’t one-size-fits-all; local laws, personal risk factors, and the unique needs of every driver shape them.

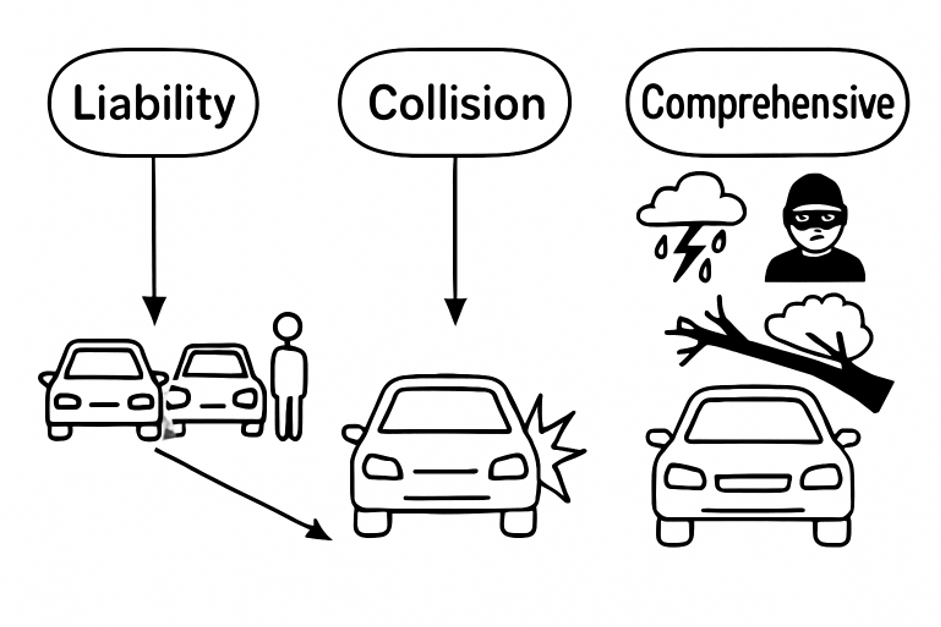

Before you choose a policy, it’s important to understand what each form of coverage actually protects against. From paying for the damage you may cause to another driver to safeguarding your own vehicle, knowing the differences empowers you to select only what you truly need.

Liability Coverage: Protecting Others

Bodily Injury Liability

Liability insurance is the foundation of most auto policies and is required by law in most states. The primary function is to cover financial responsibilities when you are at fault in an accident. Bodily injury liability pays for the other party’s medical bills, lost wages, and even legal expenses if someone you injure decides to sue. Typical coverage limits are split limits—for example, $50,000 per person and $100,000 per accident—which detail the maximum your insurer will pay in a claim.

Property Damage Liability

Besides covering health expenses, liability insurance also pays for any property you may damage. This could include a vehicle, a fence, a building, or other physical asset. If you cause a crash, your property damage liability ensures the other party’s loss is covered up to your policy’s limits. However, it’s critical to know that liability coverage only protects other people and their property—it will not pay for your own injuries or vehicle repairs.

Collision Coverage: Safeguarding Your Vehicle

Collision coverage kicks in when your car is damaged due to hitting another vehicle or object, no matter who is to blame. Whether it’s a fender bender with another driver, sliding into a guardrail on an icy road, or accidentally backing into a post, collision insurance helps pay for repairs or replacement to your car. Unlike liability coverage, you’re protected even if you’re responsible for the accident.

This type of coverage is especially important for newer vehicles or if you have an auto loan or lease, as lenders typically require it until your balance is paid off.

Comprehensive Coverage: Beyond Collisions

Comprehensive coverage guards your car against risks unrelated to crashes, such as theft, vandalism, fire, natural disasters, and even damage from hitting animals. For example, suppose a severe storm causes a tree branch to fall onto your parked car, or your vehicle is stolen from your driveway. In that case, comprehensive insurance covers the repairs or reimburses you for your car’s actual value.

These types of incidents are often outside your control. Comprehensive coverage ensures you won’t bear the full financial brunt of Mother Nature, random events, or criminal acts.

Comparing Collision and Comprehensive Coverage

While both collision and comprehensive coverages focus on your vehicle, they pay for different types of damage. Collision applies strictly to damages from car accidents—whether another car or a stationary object—while comprehensive fills in the gaps, covering incidents like hailstorms, fires, or vandalism. Many drivers combine both for broader security, especially in high-risk areas for weather events or theft.

- Collision Coverage: Damage from accidents involving your car and other vehicles or objects.

- Comprehensive Coverage: Damage from causes other than collisions, such as weather, theft, or animal impacts.

Determining the Right Coverage for You

Picking the right insurance is a personal—and often financial—decision. Weigh your car’s current value, budget, and local risk factors when deciding between just liability or adding collision and comprehensive. If your vehicle is older or not worth much, the cost of extra coverage might outweigh what you’d receive if your car were totaled. On the other hand, if you drive a new or valuable vehicle, are in a high-traffic area, or live somewhere prone to storms or crime, the investment in added protection can save thousands of dollars.

Cost Considerations and Deductibles

Collision and comprehensive coverage include deductibles—the amount you pay before your insurance pays out on a claim. Higher deductibles usually mean lower monthly premiums and more out-of-pocket expenses if you need to file a claim. Choosing a deductible you can realistically afford is important while balancing the desire for a manageable premium.

Discuss your options with an insurance professional to ensure you’re not over- or under-insured, and that your deductible matches your current financial health.

Final Thoughts

Knowing the differences between liability, collision, and comprehensive car insurance allows you to select coverage that truly suits your needs. Considering your driving habits, vehicle value, and local risks, you can assemble a policy that balances cost with peace of mind.

Take time to evaluate your options and seek expert guidance to ensure you’re protected on the road—today and in the future.